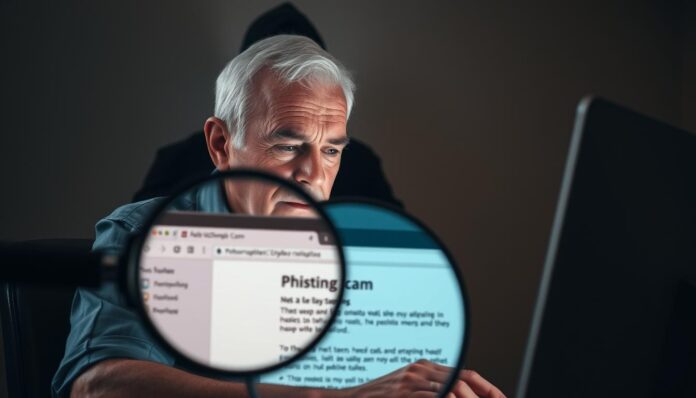

As we age, we gain wisdom but also become more vulnerable. My grandmother once called, her voice shaking. “I think I’ve been scammed,” she said. Her story is not unique.

Phishing scams targeting seniors have become a silent epidemic. They rob our elders of their savings and peace of mind.

In 2023, people aged 60 and over lost $3.4 billion to fraud. This isn’t just a number. It’s countless stories of trust betrayed and futures jeopardized.

Elder fraud has reached alarming levels. Over 100,000 seniors fell victim to financial scams in one year.

Online scams against the elderly are getting smarter. They use tech support tricks and impersonate government officials. These scams prey on our older generation’s trust and sometimes limited digital skills.

The average loss is nearly $34,000 per case. This can devastate retirement plans and alter lives.

But there’s hope. By understanding these threats and learning to recognize them, we can protect our loved ones and ourselves. This guide aims to empower seniors with knowledge – their best defense against phishing scams.

Let’s explore how to spot, avoid, and report these deceptive practices. We can ensure our golden years remain truly golden.

Understanding Phishing Scams

Phishing scams are a big problem for seniors. They try to steal personal info and money. Scammers send out thousands of attempts every day.

What Are Phishing Scams?

Phishing scams trick people into giving out personal info. They pretend to be from real companies like banks. They say there’s a problem with your account to get you to share your details.

Common Phishing Techniques

Scammers use many tricks in their scams. Over 70% of emails have bad links or attachments. They use fake tech support, delivery scams, and pretend to be the government.

Why Seniors Are Targeted

Seniors are easy targets for scammers. They have money and access to retirement funds. Their trusting nature and possible isolation make them vulnerable.

About 60% of phishing attacks are on people aged 65 and older. 1 in 5 seniors fall for these scams.

Knowing about these scams helps seniors stay safe. By understanding the tricks, they can avoid falling victim.

Recognizing the Signs of Phishing

Keeping seniors safe from financial scams starts with knowing how to spot phishing. Scammers often target older adults, using their trust and lack of tech knowledge. Learning to recognize these scams helps seniors avoid scams and stay safe online.

Red Flags to Watch For

Phishing scams have clear signs. Look out for emails with bad grammar, urgent requests for personal info, or unexpected attachments. Scammers try to rush you into making quick decisions. Be careful of messages that say you must act fast or else.

Phishing vs. Legitimate Emails

Real emails don’t ask for sensitive data via email. They are well-written. Phishing emails have bad grammar and wrong email addresses. If you’re unsure, call the company directly using a known number, not one in the suspicious email.

Spotting Impersonation Attempts

Scammers might pretend to be trusted organizations or family members. They might say they’re from Medicare, the IRS, or a tech company. Be careful of unexpected calls or emails asking for personal details or money. Always check before acting.

Remember, avoiding scams is possible with vigilance and education. If you think it’s a phishing scam, tell the FTC. By staying alert and informed, seniors can protect themselves from financial scams.

Protecting Seniors from Phishing

Phishing scams are a big problem for seniors, causing over $3 billion in losses each year. It’s important to keep their money safe, as they have a lot in their homes and retirement savings. Let’s find ways to stop these scams and keep our loved ones safe.

Effective Safety Tips

Teach seniors to be careful with emails and calls they don’t know. Tell them to check caller IDs, as scammers can fake numbers. Warn them not to give out personal info or pay with wire transfers, gift cards, or crypto.

Sign them up for the National Do Not Call Registry to cut down on unwanted calls.

Importance of Security Software

Make sure seniors’ devices have the latest security software. This helps block phishing attacks. Use tools like Carefull or EverSafe to watch for suspicious activity.

Keep all software and systems up to date to fix security holes.

Educating Family Members and Caregivers

Family help is vital in stopping phishing scams. Have family talks about money and scams. Teach caregivers about fraud tricks, like making things seem urgent or pretending to be someone they’re not.

Encourage talking about money worries and using online tools to spot scams. Working together, we can shield our seniors from phishing and keep their money safe.

Resources for Assistance and Reporting

Elder fraud is a big problem, with older Americans losing about $28.3 billion a year. It’s important to protect seniors from financial scams. There are resources to help, like the National Elder Fraud Hotline.

Organizations for Senior Support

The National Elder Fraud Hotline is open Monday to Friday, 10 AM to 6 PM EST. It has trained staff who help in English, Spanish, and more. They are quick to respond to concerns about elder fraud.

How to Report a Phishing Scam

It’s key to report suspected fraud to stop scammers. The hotline connects seniors with case managers. They help with reporting at federal, state, and local levels. For online scams, the FBI Internet Crime Complaint Center is also helpful.

Helpful Online Resources and Tools

The Federal Trade Commission’s Report Fraud Webpage is a place to report fraud. Always remember, banks never ask for personal info or passwords. By staying informed and using these resources, seniors can fight off phishing scams and elder fraud.